COLLECTIONS

Optimise collection strategies with purpose-built tools

Reduce cost to serve and improve operational efficiency with configurable workflows and flexible payment solutions

.png?width=627&height=594&name=Group%205403%20(2).png)

.png?width=401&height=401&name=radial%208996%20(1).png)

Partnering with Industry Leaders

Transform your collections management through process automation and data insights.

Automated campaigns

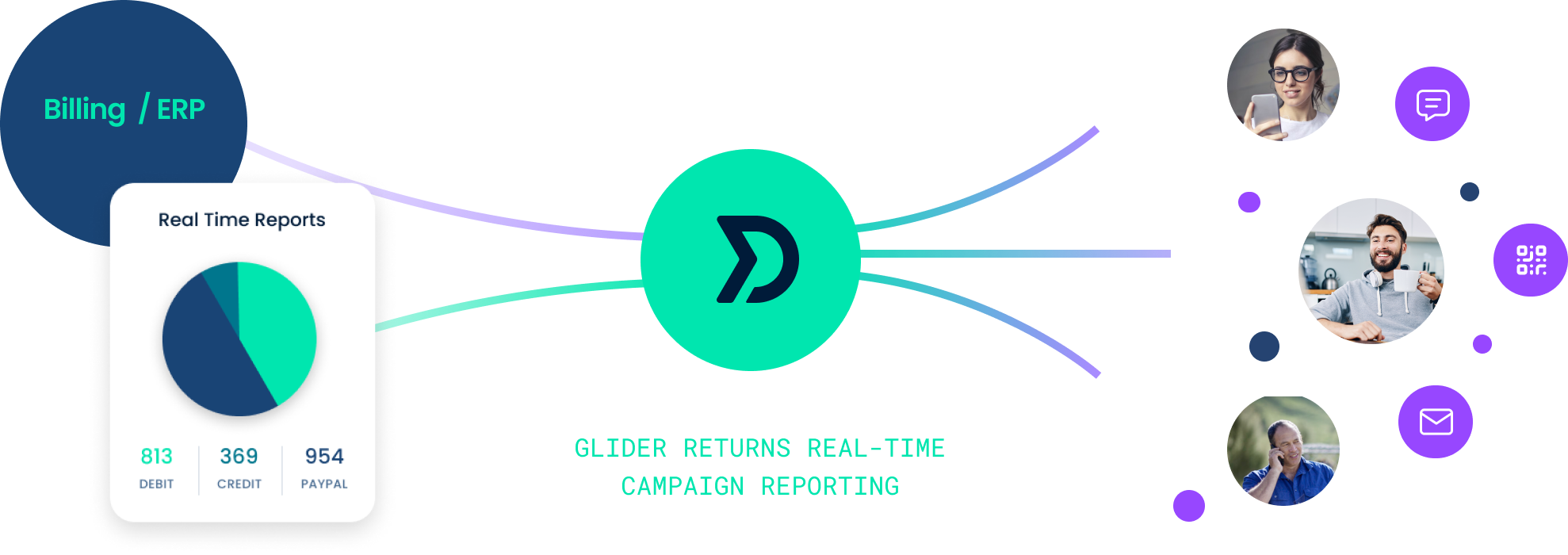

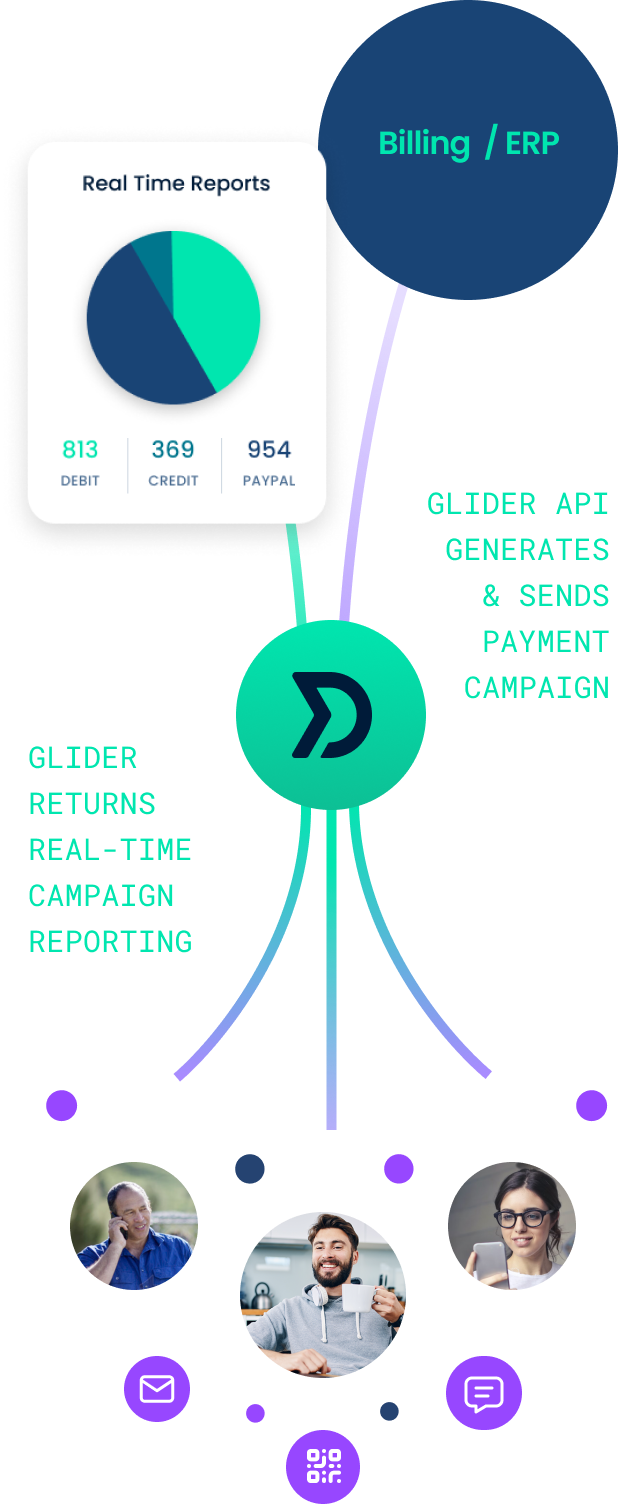

Transform large volumes of overdue payments into user-friendly, personalised payment experiences. Or send one-off requests based on custom triggers, all with the same API request.

Offer flexible payment plans

With Glider you can present the customer with the option to pay their overdue bill in full now or to pay over time using flexible instalment arrangements.

Improve PCI compliance

Makes every call PCI-DSS compliant by reducing the scope for your call recording, phone system and agents. Your credit and collections teams can manage secure payments via phone and webchat.

Optimise with data insights

From transaction visibility to consumer payment behaviour insights, Glider’s reporting console and APIs help organisations improve their collection experiences.

“Glider helps our customers self-serve, reducing collection calls and allowing our staff to focus on more complex accounts.”

– Managing Director, Collections Agency

53% of bill payers admit to paying bills late. Read the latest billing insights in our Decoding Australian Bill Payment Trends report.

Use our API to create payment campaigns either manually or with triggered events

Glider's payment communications capabilities

Billing

Collections

Contact Centre

In-Person

Customer Channels

Built-in Pay By Bank

Real-Time Analytics & Insights

Seamless Integrations

Highly configurable, easy to embed in your tech stack

Built-in Pay by Bank flows

Our PayTo solution works alongside your existing tech stack and can be added as a payment option across all channels—website, app, contact centre, and in-person.

Gateway-agnostic payments

Glider integrates with all major payment gateways to enable credit/debit card and digital wallets across all your channels.

Trusted and secure

Built on Amazon Web Services’ global infrastructure, Glider is compliant with PCI-DSS, SOC2 and ISO 27001, and is registered with Austrac.

Integration ready

Our enterprise-grade SaaS platform provides purpose-built web apps and APIs, making it easy for businesses in any industry to manage their payment communications.

.png?width=833&height=492&name=pexels-viktoria-slowikowska-5332246%202%20(1).png)

.png?width=855&height=870&name=Maturity%20Model%20(1).png)